Silvergate IPO | S-1 Summary

Summary

Silvergate Capital Corporation is the Maryland holding company for their wholly-owned subsidiary, Silvergate Bank ( a California-charted commercial bank that is a member of the Federal Reserve System). The bank uses the funding from non-interest bearing deposits to invest in conservative portfolio of assets (cash, short term securities and certain type of loans) and earns revenue from the portfolio.

Silvergate holding and its subsidiary (the bank) sold its lean business to HomeStreet Bank. The value of the transaction was $5.5 million pre-tax. The transaction reduced the total loans by $115.4 million and total deposits by $74.5 millions

KPIS

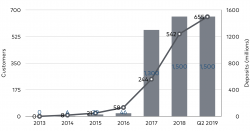

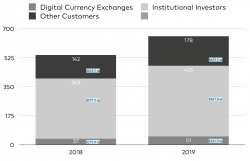

- 655 Digital Currency Customers

- 79.9% of deposits are noninterest bearing

- 18bps cost of deposit

- $1.5bn non-interest bearing deposits

- $1.2bn 3-year deposit growth

- 50.9% 3-year net income growth

- As of June 30, 2019, approximately 77% of Silvergate’s digital currency related customers are enrolled in the SEN.

- For the six months ended June 30, 2019, U.S. dollar transfers on the SEN were $12.7 billion and non-SEN transfers were $11.2 billion.

Products

The company is focused on digital currency customers. Silvergate’s flagship product is Silvergate Exchange Network (SEN). The network allows efficient movement of US dollar among the partners 24 hours a day 7 days a week. The value of SEN over existing payment networks (Wire transfers and ACH) is that the settlements are instantaneous, whereas other forms of transfers would take from a few hours to a few days. Moreover, the bank provides robust set of APIs (Application Programming Interface) that allows customers to engage with the SEN. The API allows the customers to move US dollars around the clock among the bank’s partners.

Approximately 77% of Silvergate’s eligible digital currency related customers are enrolled in the SEN.

- Silvergate Exchange Network

- Cash Management Solutions

- Deposit Account Services

The company increased their noninterest bearings from 12.4% in 2013 to 90.8% as of March 31, 2019. The growth came from digital currency customers. Their cost of deposits is 0.08% (8 basis points) and

Strategy

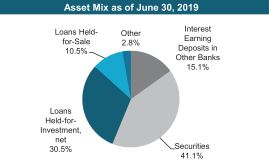

The bank earns revenue by depositing its capital (deposits from non-interest bearing ) into other bank accounts to earn interest. As of Jun 30st 2019, $1.549 Billion non-interest bearing deposits have been invested in interest earning accounts and other securities.

$920.2 million net loans were given to customers (real estate). The average yield on those loans was 5.60% for the six months ended June 30, 2019.

Growth Opportunities

- Stablecoin Transactions Flows and Collateral

- Custodian Services: The bank has identified an opportunity to open a subsidiary to provide a custodian services to institution investors. The new entity has applied to become licensed limited liability trust company in New York. The bank’s application is under the review. The bank does not custody any digital currency now.

- International Customer Base: Expand the customer base outside of the US.

- Capitalize on their Unique Market Insights: Provide insights from their SEN activities.

Corporation Structure and Offering

The company CEO is Alan Lane, who has 37 years of experience in financial sector.

The company raised the biggest fundraising round on February 23, 2018, $107.9 million. The net capital was $60 million was invested in the equity of the bank. As of March 2019, the company employed 184 persons.

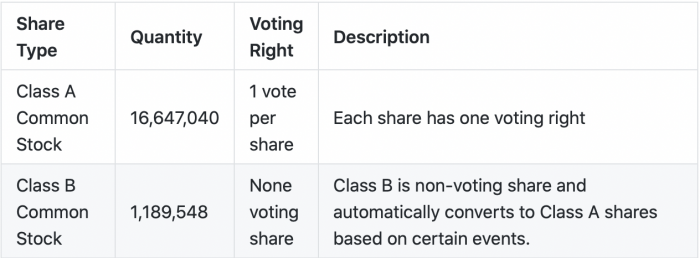

Digital currency customers own 13.1% of the company’s issued and outstanding common shares.

The total number of shareholders is 310.

The company is reserved to offer up to *5%* of the offered common shares as part of the IPO to its directors, executives, employees, and related people.

The company is planning to sell Class A common shares in NYSE under the trading symbol “SI”.

The option pool of the company has 815,491 shares of Class A Common Stock which can be exercised at the price of $5.54 per share.

Compensation

Revenue

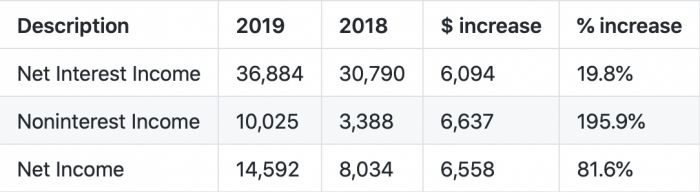

(In thousands )